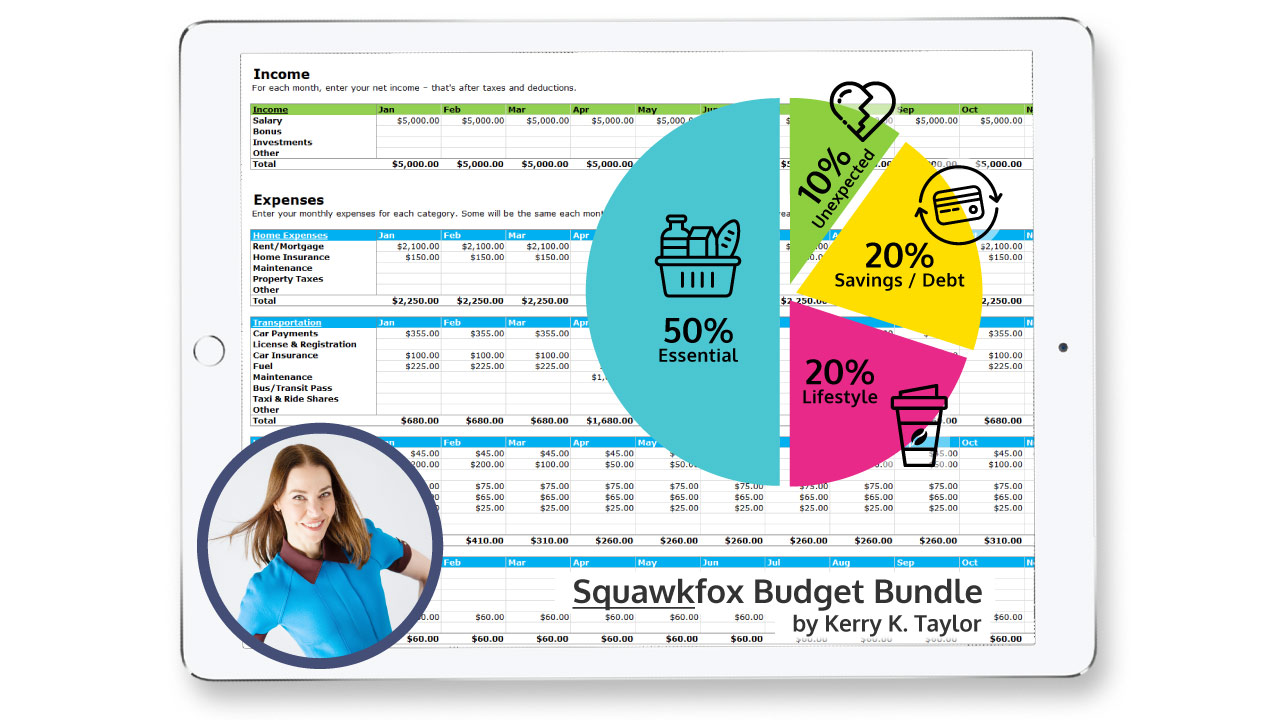

Tracking monthly expenses in a budget spreadsheet or template can help you manage your money a lot easier. Use our free budget spreadsheet to help you skip the math and start tracking and saving your money today. All data is stored on your end, so it’s private.

Regardless of which budget spreadsheet version you choose, I’ve kept things super simple by listing the biggest budgeting categories and showing you how it all adds up.

How the Free Budget Spreadsheet Helps You

- Monthly Budget: List your monthly expenses, track your income.

- Budget by year: Get an annual snapshot of your success.

- Budget for individuals: Perfect for singles or couples.

- Household budget: Build a family budget with the kids.

- Budget worksheet: Print out as a monthly budget worksheet.

- Budget calculator: Show when you’re in the red.

- Customize: Add your own categories.

- Graph it: View categories in color. See overspending.

How to use the Budget Spreadsheet

Step 1: Download!

Download the 2023 Version (with graphs) or get the Original Version (blue cells). Or get both, I won’t tell.

Step 2: Track your spending!

Tracking every cent you earn and spend sounds like work, but it’s easy to do if you carry a notebook with you or save all your receipts. The idea is to track your cash, credit card, and debit card purchases to identify the costly culprits.

How to track spending

- Use a notebook. Pack a notebook or use an app.

- Write it down: Note every purchase. Get a receipt.

- Add it up: Tally your monthly expenses. See where you’re spending.

Stick with it! Budgeting takes effort. Feeling overwhelmed and stressed is normal. But getting past the feels can lead to greater money confidence and increased financial independence.

Step 3: Get budgeting!

Grab your receipts, sort your bills, and check your bank accounts. Fill in the blanks and account for your cash. Use the budget categories for:

- Income: Salary, bonuses, investments, spousal income.

- Home Expenses: Rent, mortgage, insurance, maintenance, property taxes.

- Transportation: Car, transit, fuel, maintenance, bicycle.

- Utilities: Streaming, internet, phone, electricity, water.

- Medical: Prescriptions, dental, health insurance.

- Financial: Bank fees, interest payments, debt repayment, savings accounts.

- Enjoyment: Gifts, holiday, pets, entertainment, restaurants, hobbies.

- Routine Expenses: Groceries, clothing, personal.

- Family: Childcare, allowance, activities, books, toys.

Keep it real and own it. Wherever you spend, however much you owe, whatever you save — Your monthly totals are not your self worth, it’s your starting line. Build from here.

Step 4: Turn it around!

Facing the numbers and looking for ways to cut spending, increase income, or changing spending habits can be a messy uncomfortable process. So get messy. By facing the hard stuff and making changes you’ll turn your money around, rather than turning your back on your money.

Step 5: Repeat, Revisit, Review!

Check in with your spending, earning, and debt reduction. Stay connected to your money. Daily, weekly, or monthly. Little reviews and updates can add up to big changes. Make the change.

You can do it!

Love love love,

Kerry