- 66{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} of Americans who have used a dating app, or are open to using one, say it’s important that their partner has a good credit score.

- Half of Americans who have used a dating app, or are open to using one, wish dating apps could filter by financial status.

- 43{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} of Americans who have included their credit score on their dating profile say they received a positive reaction.

Online dating is one of the primary ways romantic partners meet. Singles can customize their dating experience, including how they present themselves to potential suitors, and how they select potential partners, based on their preferences. This online world of dating allows people to learn a lot about a person before ever meeting them IRL. Things like height, education, career and religion – even the way their voice sounds – can all be discovered before going on a first date. While one can learn a lot about a person from dating apps, they rarely get a glimpse into a person’s finances, which can be a big deal breaker in relationships.

According to a new survey conducted online by The Harris Poll on behalf of Intuit Credit Karma among 1,041 U.S. adults ages 18+ who have used a dating app or are open to using a dating app, 66{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} of them say it’s important that their partner has a good credit score, and another 87{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} say they are interested in dating someone who is responsible with their money.

Perhaps this is why more and more people are starting to post their scores on their profiles.

In fact, nearly half (49{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}) of current online daters (defined as those who currently use a dating app) say they’ve noticed an increase in the number of people including their credit score on their dating app profile.

“Excellent credit” is my type

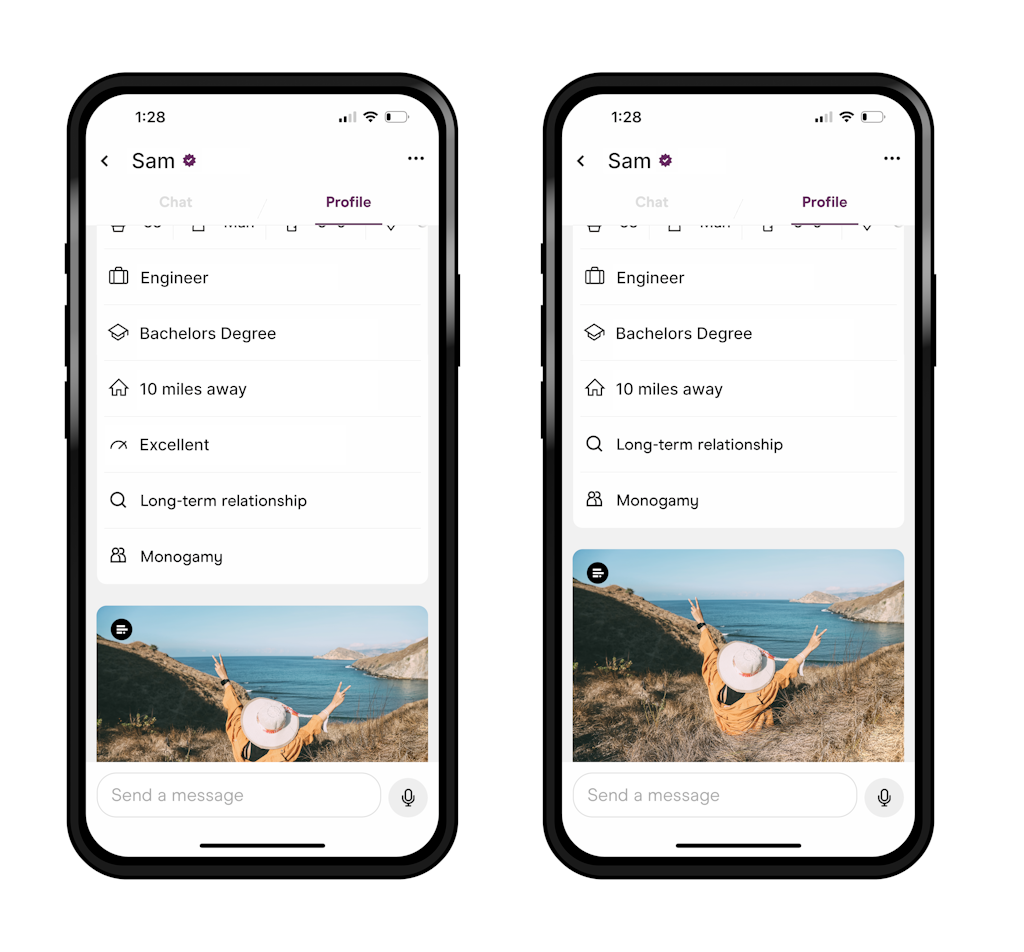

To understand if including a person’s credit score on their dating profile would sway daters’ decisions to “swipe right”, we showed Americans who have used a dating app, or are open to using one, two pairs of almost identical dating profiles, except within each pair, one profile included a credit score, either “790 – excellent” or “620 – needs work” and the others did not.

When asked to choose between the first pair of dating profiles – one with an “excellent” score and the other without a credit score – 60{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} of respondents swiped right on the profile that displayed the “excellent” credit score. Those with an annual household income of $100k+ are more likely than those with lower household incomes to choose the profile with the “excellent” credit (67{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} vs. 55{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} with a HHI of less than $100k).

Among those who swiped right on the dating profile with “excellent” credit, more than half say they swiped right because they liked that they had good credit or because it provided them with more insight into the financial status of the person – both 53{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}. Other reasons include being able to relate to the person’s credit score (33{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}) and liking that they took the initiative to share their credit score on their profile (31{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}).

Don’t ask, don’t tell

Yet, not all Americans who have used a dating app, or are open to using one want insight into a potential partner’s credit score right away, even if it’s in great standing. Among those who say they would swipe right on the dating profile that did not include a credit score over the one with “excellent” credit, more than 2 in 5 say it’s because they don’t need to know the person’s credit score (45{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}) or they didn’t like that they included their credit score on their profile (42{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}), while more than one-third (34{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}) say they don’t care what their credit score is – good or bad. Interestingly, 9{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} felt that the person’s credit score was too high, which could stem from feelings of inadequacy about their own financial standing.

Credit “needs work”? No problem.

Americans who have used a dating app, or are open to using one, also had the choice to pick between a dating profile with a “needs work” credit score, and the same profile with no visible credit score. The profile that needed some help in the credit department did not dissuade all respondents from swiping right. Instead, nearly one-third of respondents (32{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}) swiped right on the profile with a credit score that “needs work.” Those with a lower annual household income of less than $50k are more likely to choose the profile with the “needs work” credit score than those with higher annual household incomes (44{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} vs. 28{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} with HHI of $50k+).

More than half (53{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}) of those who would swipe right on a profile with “needs work” credit say it’s because even though their credit needs work, they appreciate the transparency. Others did so because it provided more insight into the other person’s financial status (41{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}) or they liked that they made the effort to include their score on their profile (38{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}), while others did so because they found their credit score to be relatable (25{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}).

Of those who did not swipe right for the “needs work” credit profile, nearly one-third (32{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}) say they didn’t swipe right because their credit was too low. This was 40{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} among those with an annual household income of $100k+.

Image: Needs-work-none-Getty1496554458

Image: Needs-work-none-Getty1496554458Credit scores on dating apps are a turn off for some women

Interestingly, many women who have used a dating app or are open to using one are not keen to see credit scores on dating profiles. Half of the women who did not choose the profile with “excellent” credit (51{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}) say it’s because they don’t need to know and 46{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} went as far as to say they did not like that they included their credit score on their profile.

Given many women don’t appear to be interested in seeing a potential partner’s credit score, it’s not surprising that 64{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} of those who have ever used a dating app, or are open to using one, say they would never include their own credit score on their dating profile, compared to 50{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} of men of the same cohort. Men might also care more about a potential partner’s overall financial situation. More than half of men who have ever used a dating app, or are open to using one (54{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089}), wish dating apps could filter by financial status, compared to 46{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} of women of the same group.

“Those in pursuit of a romantic partner often optimize for alignment around things like religion, cultural values, social views, and, increasingly, finances,” said Courtney Alev, consumer financial advocate at Credit Karma. “Because finances play such a vital role in relationships, and can cause a lot of issues if two people don’t see eye to eye, or don’t have the same financial goals, it’s good practice to get on the same page financially as early on in a relationship as possible. Adding your credit score to your dating profile can be a fun and light way to check the box on financial compatibility when first engaging with potential suitors. Not only can it serve as a funny conversation starter, but it also signals to someone that you are financially stable, and likely expect your partner to be as well. If you do include your score on your dating profile, just be vigilant about not putting yourself in a vulnerable situation where you could be taken advantage of by potential fraudsters – a good practice in online dating, regardless of your credit score.”

Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of Credit Karma from January 18-22, 2024, among 1,041 US adults ages 18 and older who have ever used a dating app or would be open to doing so. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +/- 3.6 percentage points using a 95{e6a1e97ec1a15155ca0ed8c3e87721e561c99ed6e52274045963a20278fc2089} confidence level. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact pr@creditkarma.com.