The information provided on this website does not, and is not intended to, act as legal, financial or credit advice.See Lexington Law’s editorial disclosure for more information.

Taking out a personal loan can help you get a lower interest rate and consolidate your credit debt. But a personal loan may also come with new fees and payment terms, so make sure to consider your collective monthly payment before moving forward.

Credit card debt can be difficult to keep track of. From juggling due dates to dealing with high interest rates, managing credit card debt can be time consuming.

To simplify your finances, you might consider taking out a personal loan to pay off credit card debt. After using the money from the loan to pay off your credit cards, you can then make payments toward the loan.

Unsure if this is the right option for you? In this article, we’ll weigh the benefits and drawbacks of using a personal loan to pay off credit card debt. We’ll also discuss alternative debt consolidation options to consider.

Benefits of taking out a personal loan to pay off credit card debt

In the U.S., credit card debt is on the rise, with the average balance at $5,910 per person (at the time of writing this article). If you’re struggling to make a dent in your balances, you might consider debt consolidation as a step forward. Below are the benefits of taking out a personal loan to pay off credit card debt:

1. Less interest

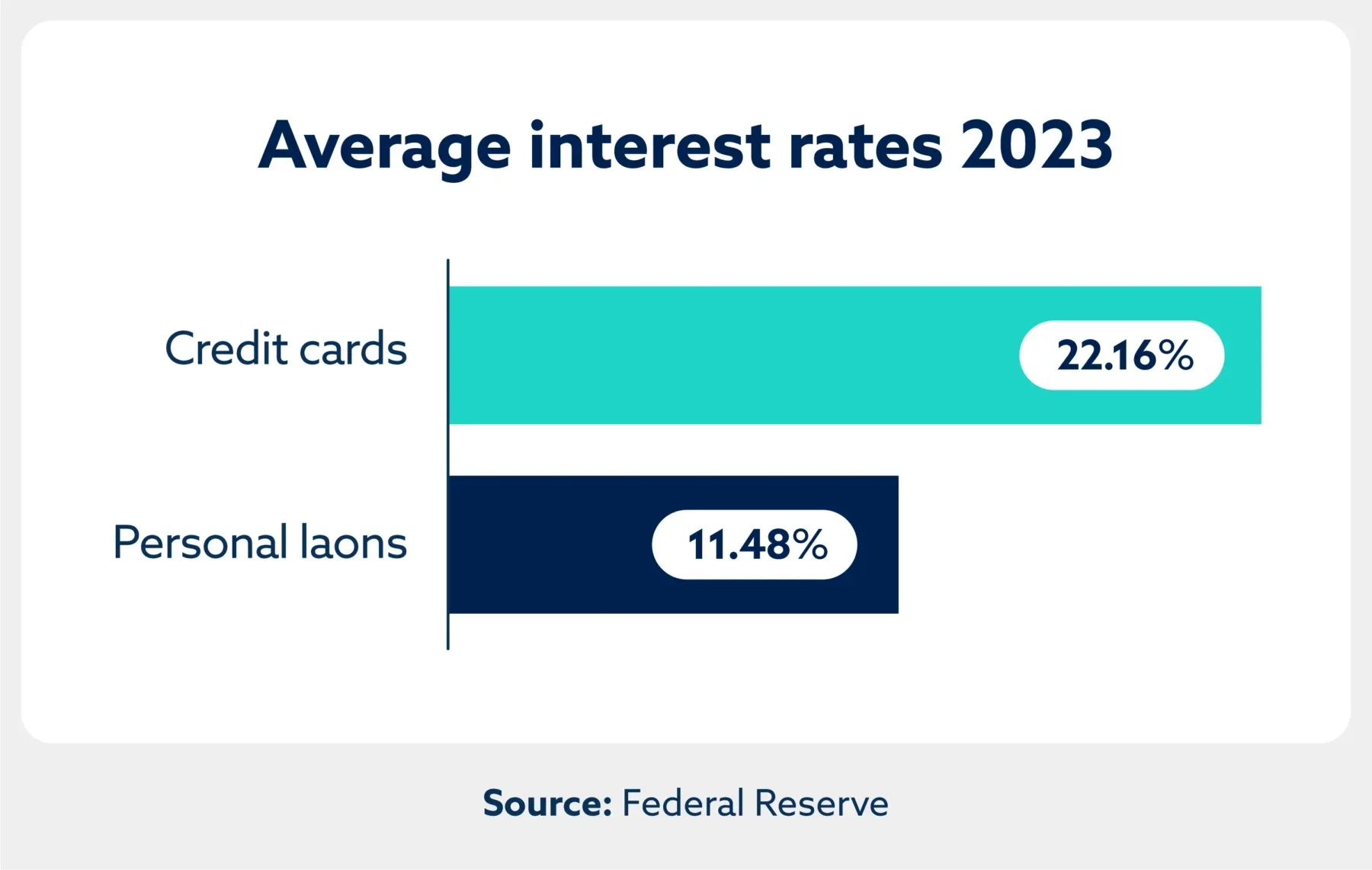

Generally, personal loans have lower interest rates than credit cards. According to the Federal Reserve, the average credit card interest rate is 22.16 percent, while the average 24-month personal loan interest rate is 11.48 percent (based on data from May 2023). Therefore, opting for a personal loan could potentially cut your interest rate in half. With less interest, you can put more money toward the principal balance and pay your debt off faster.

2. Fewer payments

If you use a variety of credit cards, then you have to pay multiple balances each month. A personal loan, on the other hand, involves only one monthly payment. Consolidating your payments into one can make paying debt easier to manage and reduce the possibility of missing a payment.

3. Better credit score

Although applying for a personal loan will trigger a hard inquiry that may temporarily cause your credit score to drop a few points, it can help improve your credit score in many ways.

First, taking out a personal loan can improve your credit mix, or your variety of credit types. If you’ve historically only opened credit card accounts, then a personal loan can add a different type of credit account to your credit mix and, therefore, improve your credit score.

Next, using a personal loan to pay off credit cards lowers your credit utilization ratio—the amount of credit you’re using divided by your total credit limit.

To lower your credit utilization even more, remember to leave your credit accounts open even after paying them off. Leaving old accounts open also keeps your length of credit history long, which is another factor that affects your credit score.

Drawbacks of taking out a personal loan to pay off credit card debt

While using a personal loan to pay off credit card debt has many benefits, there are also some drawbacks to consider.

1. Fees

Many lenders charge an origination fee to process your loan, generally between 0.5 and one percent of the loan amount. Other fees include application fees, late payment fees, returned check fees and prepayment penalties. Depending on how much lower your loan interest rate than your credit cards, these fees can cut out a portion of your savings.

2. Lowest interest rate isn’t guaranteed

While personal loans typically have lower interest rates than credit cards, you may not qualify for a favorable APR if you have a bad credit score. Those with very poor credit may not qualify for a personal loan at all.

3. Potential to get deeper into debt

Taking out a personal loan can perpetuate the debt cycle. Therefore, you shouldn’t rack up new credit card debt while you’re paying off your personal loan. If you continue to use credit cards, you could find yourself in even more debt than you started with.

How to get a loan to pay off credit card debt

If, after weighing the pros and cons, you’ve decided that getting a loan to pay off your debt is the right option for you, follow these steps:

Step 1: Review your credit report: Get a copy of your credit report and check for errors. Dispute any inaccuracies you find with the credit bureau.

Step 2: Research lenders and compare loans: Look into banks, credit unions and online lenders. Apply for prequalification and record the loan terms you’re likely to get approved for.

Step 3: Choose a lender and complete your application. Once you’ve found the best offer, apply for the loan. You may need to submit additional documentation to complete the application process, such as copies of your ID, bank statements and pay stubs.

Step 4: Receive the funds and pay off your credit card debt: Once you’re approved, the lender will send you the funds that you can use to pay off your credit card debt. Some debt consolidation lenders may even pay your creditors directly, removing the hassle from your end.

Step 5: Make payments toward your loan. Pay down your personal loan each month. Create reminders or set up auto pay to avoid missing payments.

Alternative ways to consolidate credit card debt

If you’ve decided that taking out a personal loan isn’t the right option for your financial situation, consider other ways to pay off your credit card debt:

- Balance transfer credit card: Transfer your credit card balances to a new credit card that offers a 0 percent APR introductory period. Aim to pay off your balances before your interest rate increases.

- Home equity loan: If you’re a homeowner, you can use the equity in your house as collateral to borrow funds. Keep in mind that defaulting on a home equity loan could lead to foreclosure.

- 401(k) loan: Borrow money from your retirement plan. Generally, you can borrow up to 50 percent of your savings up to $50,000.

- Debt management plan: Enlist the help of a credit counseling agency to create a plan for paying off your credit card debt.

Paying off credit card debt FAQ

Below, we’ve answered some frequently asked questions regarding credit card debt payoff.

Is it smart to take out a loan to pay off credit card debt?

Yes, it’s smart to take out a loan to pay off credit card debt if you qualify for a lower interest rate.

What are other ways to pay off credit card debt fast?

Other ways to pay off credit card debt fast include creating a budget and paying more than the minimum amount due. Consider using the debt snowball or avalanche method to prioritize which debts to pay off first.

How do you avoid credit card debt in the future?

To avoid racking up credit card debt in the future, pay your balance off in full monthly. Make sure you’re only using your credit card to make payments that you can afford to pay back. Create an emergency fund so you don’t have to resort to credit in the case of an unexpected expense.

While personal loans are a great way to consolidate credit card debt, you’ll need a good credit score to qualify for lower interest rates. Get your free credit assessment today to view your credit score and credit report summary, as well as receive a credit repair recommendation.