Photo by Towfiqu Barbhuiya from Unsplash

When criminal charges loom, financial pressures can intensify rapidly. Balancing legal costs with everyday expenses feels like walking a tightrope. Every dollar counts, and missteps can lead to deeper debt and more stress.

However, managing debt during this challenging time is possible. By implementing strategic financial steps, you can safeguard your assets and maintain stability. Taking control now protects your finances and supports your journey through the legal process, helping you emerge stronger and more secure.

Assess Your Financial Situation

Begin by taking a comprehensive inventory of all your debts and financial obligations. List every outstanding loan, credit card balance, medical bill, and any other liabilities. Understanding the full scope of what you owe is crucial for creating an effective repayment plan. Don’t forget to include smaller debts, as they can add up and become overwhelming if left unchecked.

Next, prioritize your essential expenses to ensure your basic needs are met. Allocate funds for housing, utilities, food, and transportation before addressing discretionary spending or non-essential debts. Doing so helps prevent missing critical payments that could jeopardize your living situation or lead to additional financial penalties.

Finally, gain a clear understanding of your cash flow by analyzing your income versus your expenses. Track where your money is coming from and where it’s going each month. Identify areas where you can cut costs or reallocate funds to manage your debt more effectively.

Seek Professional Legal Assistance

Facing criminal charges requires more than just understanding the legal system—it demands strategic financial planning. Hiring a lawyer who can build a compelling case is crucial. A skilled attorney can navigate the complexities of your situation, potentially reducing legal fees and minimizing financial penalties. They provide legal representation and valuable advice on managing the financial aspects of your case.

Choosing the right lawyer can significantly impact both your legal and financial outcomes. Look for an attorney with a strong track record, transparent fee structures, and a clear communication style. Personal referrals and online reviews can help you identify reputable candidates.

Additionally, many law firms are adopting digital platforms to enhance client communication, including the use of video marketing. According to marketing experts at Accelerate Now, this strategy allows law firms to reach more people to advertise their legal services and educate potential clients. By utilizing video marketing and other digital tools, law firms can provide clearer information and better support to clients, helping you make informed decisions that protect your finances during legal challenges.

Communicate with Creditors

Open dialogue with your creditors is essential when managing debt during legal challenges. Start by informing them about your current situation, including any financial hardships you’re facing due to legal fees or reduced income. Transparency builds trust and increases the likelihood of finding mutually agreeable solutions.

Negotiating payment plans can significantly alleviate your financial burden. Propose realistic repayment schedules that align with your budget, ensuring you can meet your obligations without compromising essential expenses. Many creditors are willing to adjust terms to help you stay on track, reducing stress and preventing further debt accumulation.

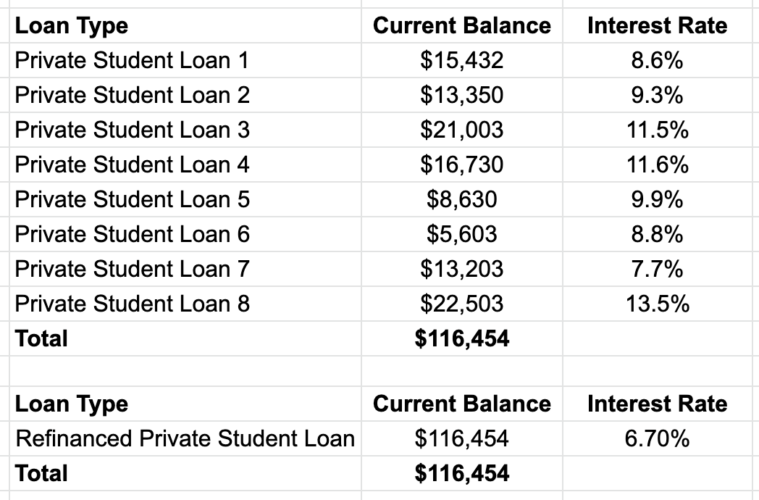

Exploring debt relief options may also be necessary. Consider solutions like debt consolidation or settlement to simplify your obligations and potentially lower your total debt. Consulting with a financial advisor can help you determine the best approach based on your specific circumstances. By proactively communicating and negotiating with your creditors, you can create a manageable path toward financial stability despite the challenges of facing criminal charges.

Utilize Available Resources

When managing debt and facing criminal charges, leveraging available resources can provide essential support. Government assistance programs may offer financial aid, unemployment benefits, or subsidies to help cover basic needs. Research and apply for any programs you qualify for to alleviate some of your financial burdens during this challenging time.

Community resources also play a crucial role in supporting your financial and legal needs. Local organizations and nonprofits often provide free financial counseling, emergency funds, or legal aid services tailored to individuals in difficult situations. Reaching out to these groups can connect you with the help you need to navigate both your legal challenges and debt management effectively.

Additionally, employment support is vital for maintaining a steady income. Utilize job placement services, vocational training programs, or online job platforms to secure or retain employment. A stable job helps in managing your debts and provides the financial stability necessary to handle legal expenses.

Protect Your Assets

Implement legal measures such as asset protection trusts to shield your property from creditors and legal judgments. These trusts help ensure that your essential assets remain secure despite financial or legal pressures, providing protection that preserves your financial stability.

Understanding exemptions is also crucial. Certain assets may be protected under the law depending on your jurisdiction and the nature of your charges. Familiarize yourself with these exemptions to prevent inadvertently exposing protected assets to risk. This knowledge allows you to make informed decisions about which assets need additional protection and how to best secure them.

Consulting financial advisors can further enhance your asset protection strategy. Professionals can guide you in implementing effective legal instruments and making informed decisions about your financial assets.

Manage Stress and Seek Support

Photo by Kaboompics.com from Pexels

Stress from managing debt while facing criminal charges may lead to anxiety, depression, or other emotional challenges. Acknowledging these feelings is the first step toward maintaining your well-being during this difficult time.

Seeking professional help can provide essential support. Counseling or therapy offers coping strategies and emotional assistance, helping you navigate the complexities of your situation. Mental health professionals can guide you in managing stress, improving resilience, and maintaining a positive outlook despite the challenges you face.

Building a strong support network is equally important. Rely on family, friends, and community members for emotional and practical assistance. Support groups can connect you with others in similar circumstances, fostering a sense of understanding and solidarity.

Wrapping Up

Managing debt while facing criminal charges is undoubtedly challenging, but it’s achievable with the right strategies. By assessing your financial situation, seeking professional legal assistance, creating a realistic budget, communicating with creditors, utilizing available resources, protecting your assets, and managing stress, you can navigate this difficult period more effectively. Each step plays a crucial role in safeguarding your financial stability and supporting your legal defense.