This is a sponsored post written by me on behalf of E*TRADE for IZEA. As always opinions are 100{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} mine and never influenced by any brand.

Tax season is a topic we love to hate. Nothing feels worse than working hard all year long only to end up with several hours of tax prep, followed by a large tax bill.

As business owners our taxes aren’t quite as simple as they used to be when we were employees with a W-2 from our jobs. Our business and knowledge of success continues to grow and because of this we’ve become investors too (even if we’re in the beginning stages). We see the importance of investing in our future.

As you prepare for the tax filing deadline, here are 5 things you can do to reduce tax season stress and make it less of a pain in the butt.

1. Break Out Your Favorite Beverage

Whether it’s wine, coffee, soda, or something a bit stronger (I won’t tell, I promise!) get yourself hydrated with your favorite drink. Any type of work is better when you can look forward to doing it, even if it’s just because you can indulge in your favorite beverage.

I don’t drink soda (holy sugar headache, batman!) but on occasion I’ll share one with my husband. This way I can entice each of us to sit down, share a soda, and do our taxes together. You could even take this a step further and break out a dessert, or get take out.

The point is to make prepping your taxes for filing a more enjoyable experience. Notice I didn’t say that it would be fun, but that the process can be less of a pain.

2. Keep More of Your Hard-Earned Money

You’ll pay for it now or you’ll pay for it later, but in the end you’ll have to pay. So why not keep the control in your hands and invest money into tax-advantaged accounts? Put your money into your own account instead of paying the IRS.

As a business owner, there are several tax-advantage accounts you can participate in throughout the year that give you a deduction or credit on your tax return.

The most popular options include:

- Health Savings Accounts (HSAs). This is one of the best ways to receive health insurance coverage as a self-employed individual and still be able to afford the premiums. You also have more control over your money and can still receive a tax deduction for any contributions.

- Roth IRAs. As an individual investor you can participate in either a Traditional or Roth IRA account, but I prefer the Roth IRA because the money you earn in interest over the years is completely tax-free. You don’t get a tax benefit when you put money in, but instead can qualify for other credits (like a Saver’s Credit).

- Solo 401(k). This individual 401(k) is similar to a regular 401(k) plan funded by an employer, and you can choose between a Traditional or Roth account inside the plan. This gives you the option to contribute pre-tax funds (that will be taxed when you withdraw the money) or post-tax funds that will be tax-free.

- Tax-free Municipal Bonds. A municipal bond (or “muni”) is essentially a loan to your local government when they need money to finance a new project. Instead of going to the bank for financing, they ask the community to fund certain projects who, in return, earn tax-free interest in return for borrowing their funds.

By choosing to put your money into these type of account throughout the year, you’ll be rewarded with tax deductions and credits that can lower your tax bill. In essence you’ll be able to keep more of your hard-earned money by paying yourself and saving for your future.

3. Find Tools to Do the Grunt Work

A recent E*TRADE StreetWise survey of experienced investors showed that many individuals and investors are tax conscious but most aren’t using the tools available as a way to limit the amount of taxes they pay. Why would you not use tools to help you save on taxes? That’s a crazy statistic to me!

Technology has made it so simple to find the answers to your tax questions, so why not make your life less stressful by utilizing them?

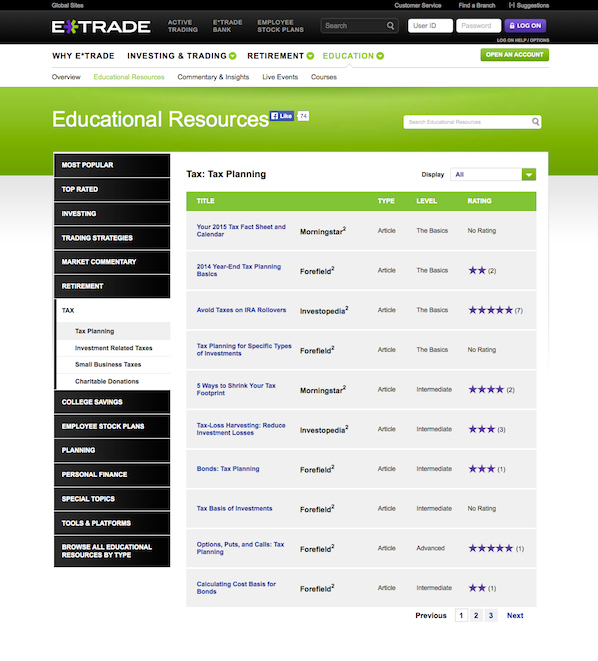

With tax day just around the corner, take time to look for resources that can do the work for you, or at the very least can help you become educated about the process. For example; the E*TRADE Education Center offers a host of educational resources that are available to all types of individuals and investors.

And the best part is that you don’t have to be a customer, or even log in, to use their free tools. Their tax planning sections explores investor behavior when it comes to taxes and offers tools and resources to help you manage your taxes now, and in the future.

And the best part is that you don’t have to be a customer, or even log in, to use their free tools. Their tax planning sections explores investor behavior when it comes to taxes and offers tools and resources to help you manage your taxes now, and in the future.

4. Know Your Strengths (and Weaknesses)

The big debate when it comes to taxes is whether or not you should do them yourself or hire a professional. The right decision comes down to this simple fact; do you already know, or do you want to learn, how to do taxes? If yes, then by all means tackle them yourself.

The reason I became a Tax Specialist and worked during tax season for four years was because I wanted to do my own taxes. At the very least I wanted to make sure I had some control over my finances and that I knew the information I received was accurate.

This is one of the great things about the E*TRADE Education Center as it offers a number of easy-to-use tools and resources for anyone who wants to understand their taxes better. If you have the time and want to learn exactly how the tax system works, then investing the time could really pay off in the long run.

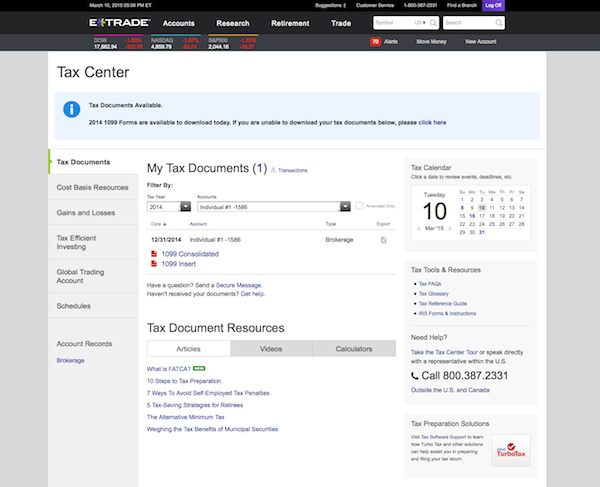

If you’re an E*TRADE customer, check out the Tax Center, which provides a variety of tools and resources all in one place; such as information on cost basis reporting and tips on managing capital gains and losses, to frequently asked tax questions.

However, if numbers and tax laws are not your thing, then do yourself a favor and spend the money to have a professional do them for you. No one is going to care about your money like you do, but that doesn’t mean you have to be a control freak and do everything yourself.

Know your strengths and your weaknesses when it comes to doing your taxes and you’ll be able to make the process less stressful.

5. Disconnect From the Numbers

Without even meaning to, the number in our bank account is tied to feelings of self-worth, are a measurement for success, and often dictate our moods. Likewise, having to shell out money for taxes can lead to stress and taking things a bit personally.

Why is the government gouging us? Why are we paying so much? Why can’t we claim those deductions?

You’re not alone in these questions, but one thing you have to remember is that these are just numbers. The government isn’t out to personally rob you — even if it feels that way. We all have to pay our share, and even more so as investors, business owners, and budget-minded wealth builders.

Be proud of the fact that you’re able to earn a decent living and can contribute money to better our overall economy. I have a friend who calls her tax savings account a blessing because she feels blessed that she can contribute.

Instead of being so attached to the tax numbers, remove yourself out of the equation and try to focus on the big picture. I know the tax system isn’t perfect (far from it actually) but I feel honored that I can be a contributing member of society and not someone who becomes a drain in the system.

No one has to take care of me! In fact, I want to help take care of others, and that’s what my tax payments help do.

Take the Stress Out of Tax Season

As the tax deadline quickly approaches, take these steps to ease the stress and make tax filing a less painful process.

Keep in mind that this only comes around once-a-year (thank goodness!) and focus on the fact that you’re making money and have the privilege of contributing in more ways than one.

What’s another way you plan to reduce tax season stress this year?

The post Make Tax Season Less Painful: 5 Things to Reduce Stress appeared first on Careful Cents.

SOURCE: Careful Cents – Read entire story here.