One of the first things I started thinking about after I started making my first couple investments in the crypto space (and especially after one of them went up like 15-20x in a matter of two years), I’m like, “huh, it would be really great if I could get this crypto in an IRA.” That way it can grow without ever having to deal with taxes on it.

I think Crypto IRAs are a great idea when it comes to investing because I can get some of my crypto investments inside of the wonderful Roth IRA.

So, in this article I am sharing exactly how I went about opening a crypto Roth IRA. And how you can, too!

But, this one will probably be better to watch on Youtube rather than read, and you can do that below:

If you would rather read the full transcription, you can do so here in this article!

Roth IRAs and why I like them

If you’re not familiar with some of the benefits of doing this, and I’m specifically talking about a Roth, go back and watch some of our other lessons in our 10X investing course about using the Roth IRA and how great it is. But I just view the Roth as like a shield to protect you from having to pay taxes on anything.

I’m always trying to figure out how I can get as much under that shield as possible and so why not get crypto in there? And so I started Googling around. I realized, okay, great. There are self-directed IRAs, which is self-directed IRAs are ones that you can basically put any kind of assets in. Sometimes it can get kind of complicated, but there’s multiple places set up that can allow you and help you to invest, basically create an IRA with crypto assets in it (click to find common investing tips).

And so I went and looked at a few different ones and I’ll just kind of flip through and just show you what my research was.

Alto CryptoIRA

So I ultimately went with Alto CryptoIRA. I went with it for a couple different reasons. It seemed very intuitive and simple to use. Some of crypto IRAs are really complicated and you have to open an LLC just to be able to do it. That just seemed like too much stuff that I didn’t want to get involved in.

So this is what I ultimately went with. But their fee structure is really simple and I liked that about them. They also have 200 different coins (and they might have had a little bit less when I started with them), but just a lot of different options of coins you can invest in. And so I was interested in that.

Directed IRA

Another one I was looking at is this Directed IRA. This one just felt as, I was just kinda exploring the way the process would be like. It just felt kind of confusing and not super clear. And so the pricing, I didn’t really like the way that they were doing it. It was just going to end up costing me more. It just felt a bit clunky to me, and so I just kind of ruled that one out for that.

Bitcoin IRA

This Bitcoin IRA one from what my, you know, my research on it, it seemed pretty intuitive and pretty simple to use. But at the time they only had, I think you could only invest in like two or three crypto coins. Now they have 60, so they have a bit more.

The pricing I think is ambiguous. I don’t think they even have it on the site or I wasn’t able to find it. So anyway, I was kind of considering this one. But for me, like what I was looking for really. To attempt to build some sort of, do-it-yourself index funds, of just a lot of different coins and have them all in this Roth.

And so again, this one only offered a couple at the time. Originally I think it was just Bitcoin and now they have 60 coins, but Alto has 200. And so that was what I ended up going with.

Two other ones I was looking at real quick. And I’m just showing these just in case. Your situation might make more sense with one of these.

Rocket Dollar Self-directed IRA

Rocket Dollar a good place to start. Start research with some of these maybe rocket dollar. You know, they, I really liked their setup, the way they were doing things. I think the pricing might not have been, is good on this one. I don’t recall the exact kind of reason I didn’t go with them, but that was another one I was looking at.

ITrust Capital

And then ITrust capital. This one just again, didn’t feel super intuitive to me the way the whole process is. And it might have been one of the ones where you have to open the LLC and I just wasn’t very interested in that.

All that to say, I ended up going with Alto. And again, I didn’t know what to expect when I would get in there, but the process was actually very, relatively easy.

And so I say easy because it’s easy in the context of having to open some sort of investment account. Because you know, if you’ve never opened an investment account, it might feel like a good amount of work because you have to do stuff. And you might have to send them a picture of your driver’s license. You might have to sign a form and email it to them, or something like that. Like that’s just really common when opening any investment account or bank account.

So I did have to do some of that stuff. I remember I had to fill out a form. And part of this was because I was rolling over an IRA from from another firm, or part of it anyway.

The risk and outlook

So, yeah, like I don’t want all of my retirement assets in crypto (how much should you save for retirement?). Like, I think that’s foolish. I don’t want to do that. That’s too, it’s too much of a risk. But I did want to move a percentage of my retirement assets (how to retire in 10-15 years) into crypto. Because I’m very optimistic over the long term of the potential.

The process

So, and so this, this was just super easy. Like I, yeah, I just felt like the whole process was super simple, really quick and was able to just kind of move through quickly, the steps. I think I had to contact their support a couple times and they were good to work with. So all that to say yeah. If I have to recommend one, if you are looking to open an IRA, you know, and you’re in a similar situation to me, like, I found this to be really helpful.

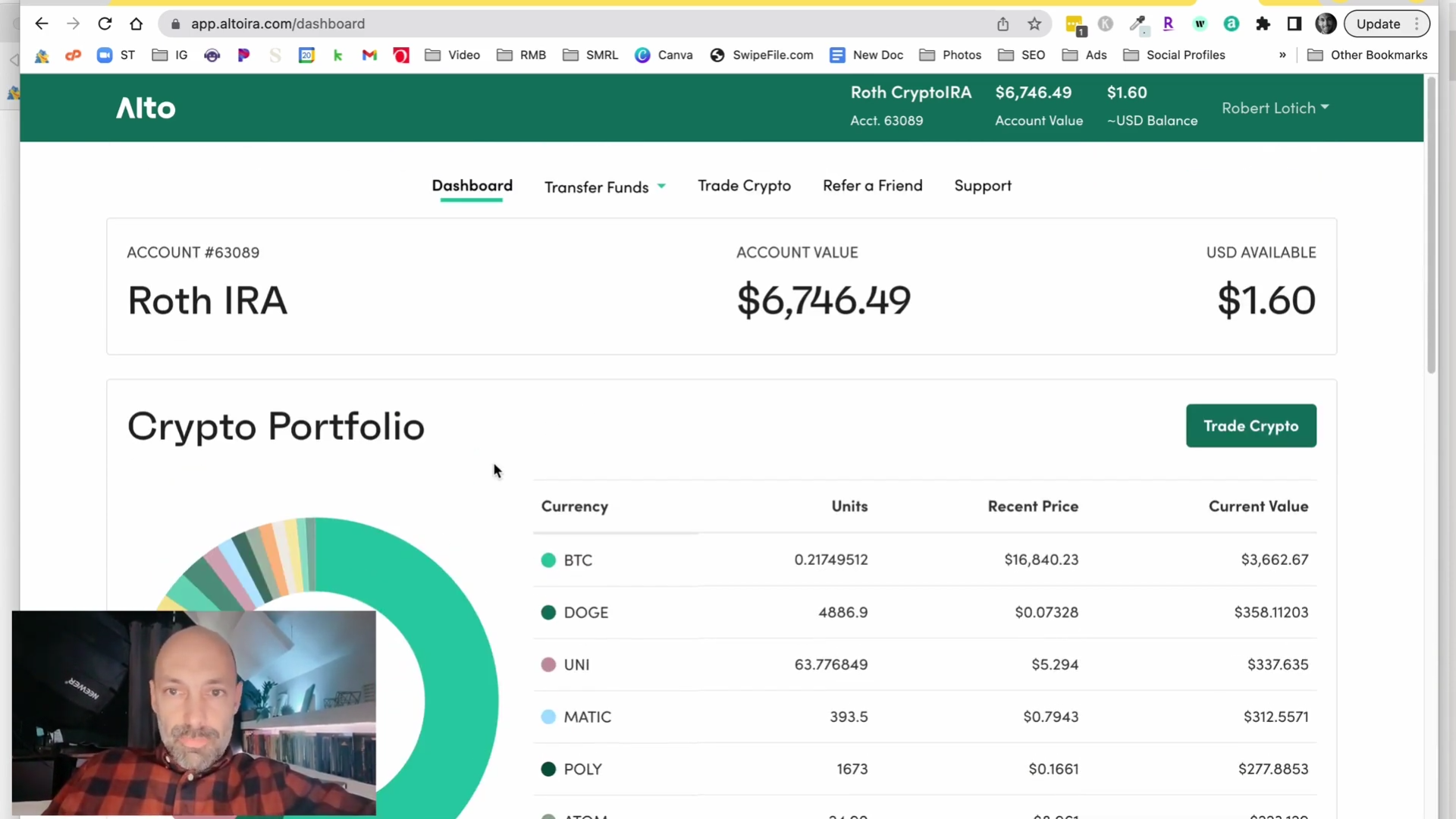

A look at my Alto CryptoIRA account

So here we are over at my Alto IRA account. Just kinda giving you a peek of how it’s laid out. It’s pretty simple. And yeah, I’ve just found it to be really intuitive. So what I did and what you can do is cash contributions. You know, adding money to it. But you can also do rollovers. And so I did a rollover from one of my other IRAs, basically just pulling off a section of that to be able to have some of it in crypto.

I just love this idea, like crypto with the huge upside potential. Definitely plenty of risk. If it plays out over the long term, like I am hoping and expecting, that should be a pretty tremendous increase over the next five or 10 years. In which, it’ll be fantastic if we can have that wrapped up into an IRA and not have to worry about taxes on it.

So that’s kind of my thinking and why I’m excited about this. But, you know, you can obviously transfer out of it. You can do distribution. You can do Roth conversions. You can do all the stuff. It’s just really, really simple. And I’ve really enjoyed that aspect of it.

Trading crypto is so much easier when it comes to Roth IRAs

And then of course, your actual crypto that you have in here, I think it’s so much easier to trade crypto in here than it is any of my other IRAs where I’m investing in mutual funds or index funds and individual stocks or bonds or whatever (how to invest with little money). I feel like those just seem to be just, I don’t know, just more clunky. And this is just pretty simple. It’s as simple as we have our list, like you just saw, of all the different coins that we currently own. And this isn’t even all of them (my Yieldnodes review). This is kind of our full list of everything at this point.

All I need to do is just go sell some of them. So if I want to sell off, whatever, I want to sell Ethereum. I can do that and then get that. Put the order in, and then I’d have money available to invest. If I want to move it all over to Bitcoin, I could do that (my crypto bot review of “The Plan”). So it was just really simple and I’ve really enjoyed using it.

One other thing that I thought was really cool that I discovered was just that it has really good reviews on Trustpilot, which, if you’ve seen one of my other videos where I was talking about this, there’s so many online brokers and financial institutions that have just really bad reviews, online.

Because I think when it’s involving money, there’s so many people just run out and leave bad reviews really quickly. You know? And especially with crypto where people are losing money pretty easily (what to do when your investments are losing money). It’s just pretty nice to see that they have much good reviews as well.

In summary

So all that to say I’m excited. I’m happy with my decision to kind of come over and create this Roth IRA. This Crypto Roth IRA.

And so if you’re thinking like I am for the long term with crypto and would love to be able to protect some of those gains from taxes, this is a great way to do it.

So anyway, let me know if you have any questions!