With the recent news that payday loan companies in the United Kingdom are now writing off more than £220 million worth of debts, the subject of debt is both a topical and indeed a very sensitive one.

Over here in the United States, we haven’t quite got it so easy – yet. There are a number of ways you can get yourself out of debt without having to resort to the extremes. Here are a few tried and tested methods to get you out of struggle.

Work it out

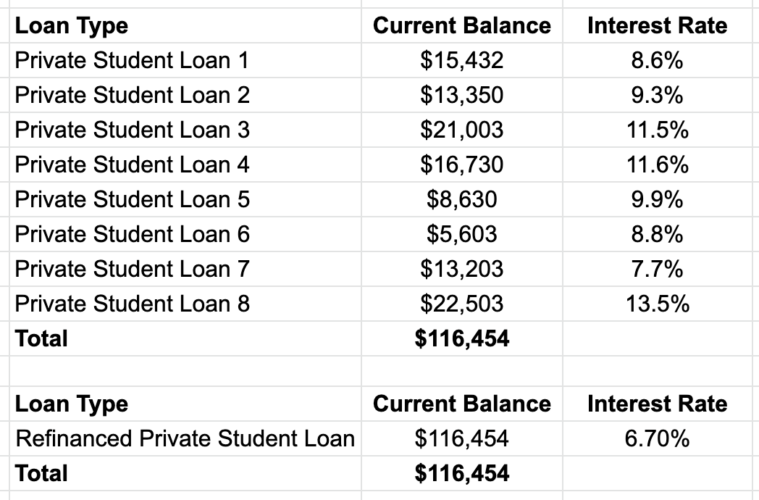

It’s going to take time and a few home truths, but you need to figure out exactly where your debt is going and who needs repaying first. See if there are any ways of consolidating your debts or stretching them out over a longer period to make it easier on your purse-strings, or have a word with your bank manager to advise the best course of action. Organize your bills and look at what comes out on what date to make sure you’re fully aware of your finances.

Limit your guilty pleasures

Rather than looking at how your can improve your income, you can also address your outgoings and separate the essentials from the non-essentials. That morning Starbucks may give your a temporary buzz, for example, but is it worth it in the long run when you add up the costs, and heaven forbid, the calories? If you can’t handle the thought of cutting out your little pleasures altogether, consider imposing limits. For example, if you’re partial to a little online fun with slots games, such as online slots at Royal Vegas Canada, try imposing not only a budgetary but a time limit too.

Use the internet for extra income

If you’re already busting a gut working outside of your home, it can be difficult to find a second job that fits around your timetable. Thankfully, the internet is now becoming host to a number of working from home opportunities, whether it’s freelance blogging or filling out surveys. Alternatively, you could also look at selling some of your old belongings on sites like eBay or Etsy to provide you with some temporary additional funds to aid debt relief.

Look into alternative suppliers

Many of us go on paying our utilities bills without even considering if we’re getting the best deal. Next time a super-speed broadband commercial comes on, take note – you could find yourself saving hundreds of dollars over the course of a year. Talk to friends too to see which deals work best for them and consider whether or not this could be best for you.

The post Four ways to get out of debt appeared first on Getting Money Wise.

SOURCE: Getting Money Wise – Read entire story here.