That’s the problem with being selective. You accept only the good submissions, or the stupendously awful ones, and pretty soon the number of submitters dwindles to a trickle. Presenting another edition of the Carnival of Wealth, the only personal finance blog carnival worth a damn. Even with only 2 submitters. One of whom is one of the aforementioned awful contingent, the other of whom is a rookie. When you’re the only legitimate submitter, unbowed by threats of search engine optimization punishment, the least we can do is name a weekly edition of the Carnival of Wealth in your honor.

That warrants some explanation, and excuse us if this is a little too inside baseball. The majority of blog carnivals are nothing but collections of links. Just look at this garbage. 83 indistinguishable personal finance bloggers submitting synopses of their latest genius, which this week’s designated honoree then copies and pastes with so little quality control that he included a few duplicates. Of course, no one’s going to read such an agglomeration, much in the same way that no one reads a telephone directory from start to finish. But, the submitting sites end up getting linked to, and that’s all that matters: another instance of the URL BoringPersonalFinanceSite.com clogging up the internet, and thus ostensibly improving the site’s Google PageRank. Now, the site owner can charge a few pennies more for advertising.

That’s all such an inferior carnival is, a festival of recursion. You scratch my back with a link, I scratch yours when it’s my turn, everybody profits. It’s foolproof! Those losers like the Control Your Cash team are wasting their time trying to write something entertaining and readable when instead they could showcase an insipid parade of links.

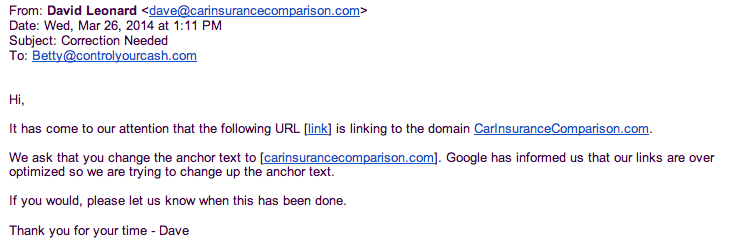

You’d be amazed at how pervasive this is. Most of our contemporaries, and we use that term loosely, fixate on Google analytics to the exclusion of everything else. You think we’re making that up? We received the following email last week (click on it to embiggen):

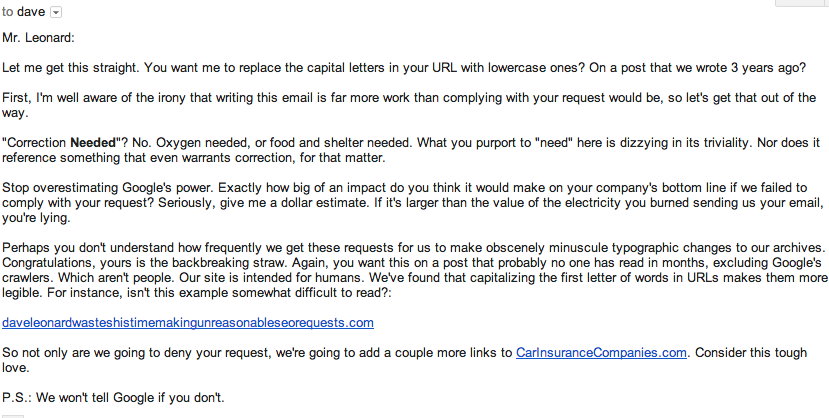

He was serious, or doing a convincing impression of being so. The legalese was a nice touch. We were serious too (ditto):

Immature? Yeah, but he started it.

You’re not going to believe this, but the folks at Google – who created this almighty algorithm in the first place – have figured out that people are trying to game the system by rounding up links and putting them on display to artificially enhance their page rankings. So some red-handed bloggers – not all, but enough, and their ranks are growing – have decided to quit submitting to carnivals altogether. Case in point, the carnival we used as a bad example above used to get over 100 submissions a week.

Well, with a carnival like the CoW, which receives fewer submissions to begin with, losing submitters is somewhat more noticeable. Not that we’re accusing our absent submitters of disappearing solely for search engine optimization reasons, mind you. But it does make for a thinner carnival. One that we’re devoting to the intrepid Andrew Pohl this week, our only legitimate contributor.

Andrew is the brains behind Finance With Reason, a site we’d never heard of before. The title of his post is a rhetorical question, or at least we hope it’s rhetorical. “Should I Invest in Penny Stocks?” Ha, trick question. You can’t “invest” in penny stocks, because penny stocks aren’t an investment. They’re pure speculation. And it appears that Andrew is self-aware enough to see penny stocks for what they are:

If you want to get rich quick with no effort at all then penny stocks are for you. If you think it would be a better idea to climb off of your unicorn and float down to earth instead of looking for a pile of gold at the end of a rainbow then you should stay far, far away from penny stocks.

There isn’t more to it than that. Yes, a stock that sells for 6¢ a share has an excellent chance of doubling in value. More than, say, Berkshire Hathaway stock, which is currently trading at $185,149 and won’t be making it to $370,298 anytime in the short term. Of course, the obvious downside to a stock trading at 6¢ is that a 6¢ drop in its price is fatal. Andrew knows this now, but didn’t know it when he was 18. He got educated the hard way, but it’s much better that he did so earlier than later. We won’t ruin his post for you, but will instead encourage you to read it. Ahead of all the other submissions this week.

Back for a second week is AccuTech, a company that we made fun of last week but whose representatives insisted on returning for a second visit. AccuTech’s Jim Brewer is proud to announce that AccuTech offers “the most comprehensive heating and cooling services available in Warrington, PA.” You know what else AccuTech offers? Lots and lots of the same SEO nonsense we whined about earlier:

We can clean your air ducts that are used for heating

our pledge to you is to provide superior heating and cooling services

Whatever climate control comfort needs you have, no matter how large or small, we can meet your requirements.

We are your go-to full-service company for central AC and heating

Enlist our help with air conditioning and heating services near Warrington PA today.

Not with a bang but a whimper. And we’re done, hopefully not permanently. Catch us on Investopedia. And on the Stacking Benjamins podcast, weather permitting. See you tomorrow.

SOURCE: Control Your Cash: Making Money Make Sense – Read entire story here.