Navigating financial systems in a new country can be a daunting task, especially in the United States where credit plays a pivotal role in many aspects of life. From securing a loan to renting an apartment, your credit score can be the gateway to numerous opportunities. This article serves as a guide for newcomers to the U.S., explaining how credit works here compared to other regions like Europe, the Philippines, and the Caribbean, and outlining practical steps to build a robust credit history from scratch using various credit builder strategies.

In this article, we’ll take a look at:

How Credit is Used Globally

Europe

In Europe, credit scoring systems vary by country but generally revolve around data protection regulations and consumer rights. Unlike the U.S., where credit scores are central to lending decisions, some European countries rely more on income and expenditure data to assess creditworthiness.

The Philippines

The credit system in the Philippines includes both formal and informal lending practices. Formal bank loans and credit opportunities are complemented by widespread informal lending, making the system quite dynamic. However, credit reporting and scoring are still developing, unlike the structured systems seen in the U.S.

The Caribbean

Credit practices in the Caribbean can differ significantly, with some islands having more developed credit reporting systems than others. Like in many parts of the world, access to credit and the importance of a credit score can vary widely, with a heavy reliance on personal banking relationships and less emphasis on credit scoring.

Similarities to U.S. Credit Systems

Countries like Canada and the United Kingdom share more similarities with the U.S. credit system. These countries use credit scores extensively in financial decisions, maintain major credit reporting agencies, and credit scores are influenced by similar factors such as payment history and credit utilization. This makes their systems somewhat familiar to those accustomed to the U.S. approach.

Understanding U.S. Credit

What is a U.S. Credit Score?

A U.S. credit score is a numerical expression based on a level analysis of a person’s credit files, to represent the creditworthiness of an individual. This score is used by lenders, landlords, and even employers to gauge how risky a proposition it is to lend to or engage with you.

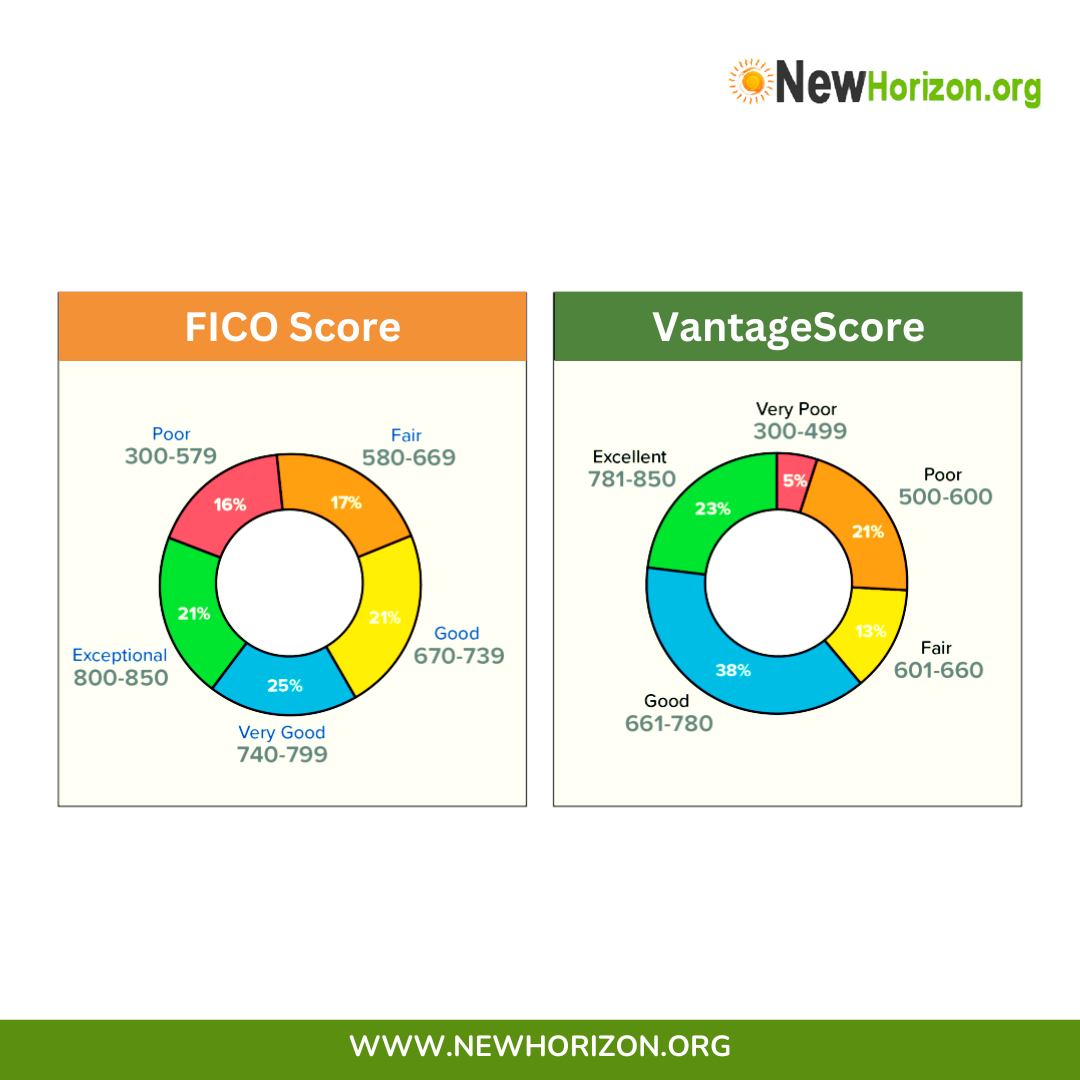

FICO Score and VantageScore: Key Credit Scoring Models

FICO and VantageScore are the two primary credit scoring models used to assess creditworthiness in the U.S. FICO, developed by Fair Isaac Corporation, is the most established and widely used model, particularly important for mortgage approvals.

It emphasizes payment history, credit utilization, and the length of credit history.

VantageScore, created by the three major credit bureaus—Experian, Equifax, and TransUnion—offers a more uniform scoring method that can be more favorable for individuals with shorter credit histories. While both models use a scoring range from 300 to 850, they differ slightly in their scoring criteria, with VantageScore adjusting more quickly to recent credit behaviors.

Components of a Credit Score

- Payment History (35%): Having a positive payment history of paying bills on time is the most significant factor.

- Credit Utilization (30%): How much of your available credit you are using.

- Length of Credit History (15%): The age of your oldest credit account, and the average age of all your accounts.

- Types of Credit Used (10%): The mix of account types, such as credit cards, mortgages, and car loans.

- New Credit (10%): The frequency of credit inquiries and new account openings.

Understanding Credit Score Ranges and Their Impact

Credit scores in the United States are calculated to help lenders quickly understand your creditworthiness. These scores can significantly affect the interest rates you are offered on loans, credit cards, and other financial products. Here are the typical credit score ranges along with the potential financial implications of each:

Excellent (800-850): An excellent credit score puts you in the best position to receive the lowest interest rates and the most favorable loan terms. Lenders see you as an exceptionally low-risk borrower.

Excellent (800-850): An excellent credit score puts you in the best position to receive the lowest interest rates and the most favorable loan terms. Lenders see you as an exceptionally low-risk borrower.- Very Good (740-799): Those with very good credit scores can expect to receive better-than-average interest rates from lenders, which can save you significant amounts of money over the life of a loan.

- Good (670-739): A good credit score means you are a low-risk borrower, though you may not receive as low an interest rate as those in higher categories.

- Fair (580-669): Considered below average by most lenders, a fair credit score means you are seen as a subprime borrower. You might still qualify for certain loans and credit, but with higher interest rates.

- Poor (300-579): With a poor credit score, it can be challenging to secure credit, and the available options often come with high interest rates and unfavorable terms.

Example of Interest Rate Variations:

For a $20,000 auto loan:

- Excellent Credit Score (750 and above):

- Interest Rate: 3%

- Monthly Payment: $359 over a 5-year term

- Total Interest Paid: $1,565

- Total Loan Cost: $21,565

- Fair Credit Score (600-649):

- Interest Rate: 10%

- Monthly Payment: $425 over a 5-year term

- Total Interest Paid: $5,481

- Total Loan Cost: $25,481

- Bad Credit Score (below 600):

- Interest Rate: 16%

- Monthly Payment: $487 over a 5-year term

- Total Interest Paid: $9,199

- Total Loan Cost: $29,199

- Note: In this case, banks may also require a security deposit or additional collateral due to the higher risk.

Understanding where your credit stands and taking steps to improve it can save you thousands of dollars in the long run due to lower interest rates and better financial opportunities.

Credit Checks: Hard vs. Soft Inquiries

When you hear the term “credit check,” it generally refers to the process by which a lender, employer, or another entity reviews your credit report to assess your financial behavior and creditworthiness. There are two main types of credit checks: hard inquiries and soft inquiries, each affecting your credit differently.

What is a Hard Inquiry?

A hard inquiry, also known as a hard pull, occurs when a financial institution checks your credit report as part of a lending decision. This type of inquiry is common when you apply for a credit card, a loan, or a mortgage. Hard inquiries can slightly lower your credit score and may remain on your credit report for up to two years. The impact is usually minor, but multiple hard inquiries in a short period can add up and have a more significant effect.

What is a Soft Inquiry?

A soft inquiry, or soft pull, happens when a person or company checks your credit report as part of a background check. This could be when you are pre-approved for credit card offers, or when you check your own credit score. Soft inquiries do not affect your credit score, regardless of how frequently they occur. They can happen without your explicit permission and do not reflect any intention on your part to take on new credit.

Key Differences

- Impact on Credit Score: Hard inquiries can slightly decrease your credit score for a short period, while soft inquiries have no effect at all.

- Permission: Hard inquiries require your explicit consent, whereas soft inquiries might not.

- Purpose: Hard inquiries are tied to actual credit applications, while soft inquiries are often used for pre-approvals or personal credit checks.

Why it Matters

Understanding the difference between these types of credit checks is crucial because it can help you manage your credit inquiries wisely. For instance, if you’re shopping for a loan, try to limit your applications to a short period to minimize the impact of hard inquiries. Knowing that checking your own credit score is a soft inquiry reassures that you can do so frequently without harming your credit.

The Credit Bureaus

The three major U.S. credit bureaus—Experian, Equifax, and TransUnion—play a critical role in collecting and maintaining credit information. Each bureau can score slightly differently, so it’s important to check your credit report from all three to get a complete picture of your credit health.

Building Credit in the U.S.

Secured Credit Cards

Secured credit cards are a fantastic starting point for building credit. They require a security deposit that typically serves as your credit limit. These cards are easier to obtain than standard credit cards and are reported to the credit bureaus, helping you build a credit history with responsible use.

Here’s a list of some of the best secured credit cards currently available, catering to various credit-building needs:

Applied Bank® Secured Visa® Gold Preferred® Credit Card

Applied Bank® Secured Visa® Gold Preferred® Credit Card

- Better than Prepaid…Go with a Secured Card! Load One Time – Keep On Using

- Absolutely No Credit Check or Minimum Credit Score Required

- Automatic Reporting to All Three National Credit Bureaus

- CreditSoup

- A better way to get a Card Offer!

- Secured Cards

- Search, Compare, Apply!

Our recommendation: Applied Bank Secured Visa Gold Preferred Credit Card – This is a true credit builder card! This card has a low-interest rate of 9.99% fixed. You can open it with a security deposit of $200-$1000 and increase your credit limit up to $5000 by sending additional deposits. This practice can help you look more creditworthy to potential lenders.

Catalog Credit Cards

Catalog credit cards are issued by retail outlets; these credit builder cards often have lower credit requirements and can be another tool for building credit. Be mindful of high-interest rates and limited usage outside of the issuing store.

Here’s a list of catalog credit cards that offer opportunities for building credit:

- Freedom Gold Card

- $750 Unsecured Credit Limit (Usable only at TheHorizonOutlet.com)

- Instant Approval*

- No Credit Check

- Sezzle

- A better way to get a Card Offer!

- Secured Cards

- Search, Compare, Apply!

- Net First Platinum

- No Employment or Credit Check

- Bad Credit, No Credit – OK

- Always 0.0% APR

- Group One Platinum Card

- No Employment or Credit Check

- Bad Credit, No Credit? No Problem!

- Fast and Easy Application

- Boost Platinum Card

- Bad Credit, No Credit? No Problem!

- Fast and Easy Application

- No Employment or Credit Check

Our recommendation: The Freedom Platinum Card – This credit builder card will give you a credit limit of $700. It has 0% APR and NO INTEREST on purchases! They are an instant approval card with guaranteed acceptance.

Credit Builder Loans

Credit Builder Loans are designed specifically to improve your credit score. Instead of receiving the borrowed money upfront, it’s held in a bank account while you make payments. The timely payments are reported to credit bureaus, thus building your credit history with a credit builder strategy.

Utility Bills and Credit Building

Recently, services like Experian Boost allow you to add utility and telecom bill payments to your credit file, acting as a credit builder. This can be an excellent way for newcomers to show creditworthiness without traditional credit products.

Building Credit as an Authorized User

Building Credit as an Authorized User

One effective strategy for building credit, especially if you are starting from scratch or looking to improve your score quickly, is to become an authorized user on someone else’s credit card account. This approach allows the primary account holder’s credit activity to be reflected on your credit report, potentially boosting your score.

Challenges and Considerations

While this method can be beneficial, it’s not always easy to implement. Convincing someone to add you as an authorized user involves a great deal of trust, especially since the primary account holder is legally responsible for any debts incurred. Even close family members might hesitate to take this step due to the risk of accruing high charges.

Tips for Gaining Trust

Here are some tips to help persuade someone to add you as an authorized user:

- No Physical Card: Assure the account holder that you do not need to receive a physical card. This way, they can be confident that you won’t be able to make unauthorized purchases.

- Set Clear Boundaries: Discuss and agree on spending limits and usage beforehand, even if you won’t be using the card. Clear communication can help alleviate any concerns about potential misuse.

- Financial Transparency: Share your credit goals and why you need their help to build your credit. Understanding your intentions may make someone more likely to assist you.

- Offer Reassurances: Emphasize that their credit limit or spending habits won’t need to change and that you will not be accessing the credit line for actual purchases.

Benefits for Both Parties

Becoming an authorized user can be mutually beneficial. Not only do you get a chance to build or repair your credit score, but the primary account holder can earn rewards on the account based on the overall spending, including any responsible use by you as an authorized user.

By approaching the situation with honesty and clear guidelines, you increase the likelihood of someone agreeing to help you in your journey towards building a stronger credit profile.

Conclusion

Starting to build credit in the U.S. can seem complex, but understanding the foundational elements and taking practical steps can demystify the process and set you up for long-term financial success. By engaging with these credit builder tools, you can pave the way for a prosperous financial future in your new home.

Frequently Asked Questions About Building Credit

- What activity builds your credit score the most?

- Making payments on time is the single most influential factor, accounting for 35% of your credit score.

- What builds credit the fastest?

- Opening a secured credit card and using it responsibly by making small purchases and paying them off in full each month can quickly establish a good payment history.

- When will I get a credit score?

- Typically, it takes about three to six months of credit activity to establish a credit score from scratch.

- How many trade lines do I need to have to get a credit score?

- You generally need at least one trade line that has been active for a minimum of six months to generate a credit score.

- Explain what trade lines are.

- Trade lines are credit accounts that appear on your credit report. Each credit card, loan, or credit agreement you have is considered a separate trade line.

- Is it better to pay off my credit card in full or carry a balance?

- Paying off your credit card in full each month is generally better as it shows you can responsibly manage your credit without accruing unnecessary interest.

- How often should I check my credit score?

- It’s a good practice to check your credit score at least once a year, but you may want to check more frequently if you are actively working on improving your credit.

- Can paying rent build my credit?

- Yes, if you use a credit builder service that reports rent payments to credit bureaus, paying rent on time can help build your credit score.

- What are the dangers of co-signing for someone else’s credit?

- If the person you co-sign for misses payments, it can negatively affect your credit score. It’s a financial responsibility you share.

- How can errors on my credit report be fixed?

- You should review your credit reports regularly and dispute any inaccuracies directly with the credit bureau reporting the error.

- What’s the impact of hard inquiries on my credit score?

- Hard inquiries occur when a lender checks your credit for a lending decision and can lower your score by a few points, but the impact usually diminishes over time.

- Does closing a credit card affect my credit score?

- Yes, closing a credit card can affect your credit score by potentially increasing your credit utilization ratio and shortening your average account age.

- What is credit utilization, and why is it important?

- Credit utilization is the ratio of your credit card balances to their limits. It is important because it accounts for 30% of your credit score; lower utilization is generally better.

- Can I build credit with a debit card?

- No, debit card usage does not impact your credit score as it does not involve borrowing money.

- What is the best way to manage multiple credit cards?

- Keep balances low, pay bills on time, and monitor all accounts for fraudulent activity. It’s also wise to not open more cards than you can manage effectively.