The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Regularly making timely payments and keeping your account balances low are a couple of ways to use a credit card to build credit.

Your credit card habits can both positively and negatively affect your overall credit health. Responsibly using your card and making timely payments will steadily improve your credit—while the opposite habits will reduce your standing over time.

Here, we’ll discuss how to use a credit card to build credit and share some credit-building tips. We’ll also explore how Lexington Law Firm can give you a clearer picture of your credit habits.

Key takeaways

- Paying down your card balances will quickly build credit.

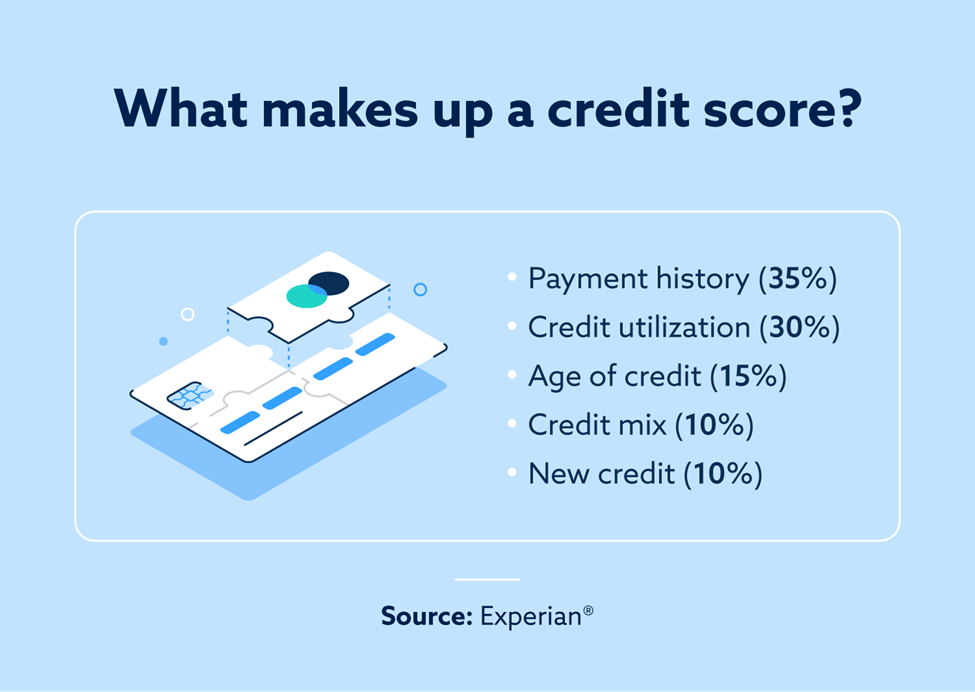

- FICO® determines credit scores based on five categories.

- Reviewing your credit report can help you strategize.

Table of contents:

Tips for building credit with a credit card

Once you know the factors that influence your credit score, you’ll better understand how to build credit more effectively. When using a credit card, keep the following tips in mind.

Make timely payments

It can’t be overstated how impactful making timely payments can be when building credit with credit cards. Paying off your card balances in full is ideal but may not always be possible due to other financial obligations. In those instances, making your minimum payment will still be beneficial for your payment history.

Keep low credit utilization

Credit utilization weighs your credit limit against your current account balance. Keeping your utilization below 30 or even 10 percent could steadily improve your credit, but if you can’t keep it that low, just try to get it as low as possible.

Here’s an example of credit utilization at play: if you have a credit limit of $1,000 and a current balance of $300, you’ll be at 30 percent utilization. If you lower your balance to $100, you’ll be at 10 percent utilization.

Be selective with your cards

As your credit score rises, you’ll likely receive dozens of credit card offers each month. Be selective about which cards you apply for—if you’re a frequent shopper at a certain store, responsibly using your credit card can improve your credit and help you get some good rewards.

Check your credit report

Your credit report should accurately reflect your financial activity, but there could be errors that are impacting your credit health – this happens more often than you might think. Lexington Law Firm can help you address unfair or inaccurately reported information on your credit reports.

How are credit scores determined?

Your activity with a credit card is interconnected with your credit score. The Fair Isaac Corporation (FICO) is a trusted credit reporting company that evaluates your credit habits based on five factors: payment history, credit utilization, age of credit, credit mix and new credit.

Responsible credit card usage can improve your credit in several ways:

- Paying down your credit card balance positively affects your payment history.

- Striving to keep your card balances low reflects good credit utilization.

- Responsibly handling a credit card for many years helps your age of credit.

- Managing credit cards and installment accounts positively affects your credit mix.

Types of credit cards

Different types of credit cards can help you build credit in various ways. Here are several different kinds of credit cards that are commonly used.

Business credit cards

If a business owner meets certain criteria, such as having an EIN or multiple years of activity, they might be able to secure a business credit card. These cards provide business owners with revolving credit that can be used for short-term purchases.

Business credit cards can affect the cardholder’s credit and their business creditworthiness. A business with great credit can be eligible for fantastic loans and better credit card offers over time.

Joint credit cards

Joint credit cards allow two people to apply at the same time and potentially open an account in both of their names. Activity with joint cards will impact both users for better or worse, so it might be best to discuss and agree on usage terms with your partner before applying.

With a joint credit card, both users will be responsible for repaying the card’s balance and maintaining a low utilization rate. If one user exceeds the joint card’s credit limit, both will see dings in their credit.

Secured credit cards

Secured credit cards require applicants to place a cash deposit when opening their account. These cards often have very flexible requirements, which makes them excellent credit cards for bad credit borrowers.

Most secured credit cards also come with low credit limits and high interest rates—largely to discourage cardholders from misusing their funds. Secured credit cards can serve as excellent starter cards and help individuals repair their credit.

Student credit cards

Standard cards often have requirements that many college students might not meet. Student credit cards can bridge that gap. These cards normally have low or no credit requirements and might even offer rewards for strong academic performance.

Securing and responsibly using a student credit card can help you build credit early in life. When you graduate and are looking to join the workforce or pursue a postgraduate degree, your better credit can grant you access to much-needed funding.

Retail credit cards

Large commercial stores and online retailers may offer these kinds of credit cards. Retail cards can only be used exclusively for store-related purchases. However, rewards like cash back and exclusive discounts might be worth it if you frequently shop at a certain retailer.

Retail credit cards can help you build credit when used responsibly. While it may be tempting to go on a shopping spree with your card, exercising restraint (and staying within your credit limit) will positively affect your credit over time.

Should I pay off my credit card after every purchase?

Payment history and credit utilization greatly impact your credit, so yes, frequently paying off your account balances is possibly the fastest way to build credit over time. Making small purchases with a credit card and swiftly paying off your balance can be an effective strategy.

Ultimately, it’s important to spend within your means and only use your credit card for purchases that you can repay.

Get your credit snapshot with Lexington Law

Credit cards can be very powerful tools for improving your credit—if you know which ones best suit your needs. Lexington Law Firm can provide a credit snapshot that includes your credit score, a credit report summary and credit repair suggestions.

If you’re thinking about applying for a new credit card, seeing where your credit currently stands is a helpful first step.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.