This article may have affiliate links that help support this website.

As many of us know, college is not cheap. Especially in the first few weeks of starting college, you are paying for new books, supplies, groceries, and class merchandise. Just like that, over hundreds of dollars is gone from your bank account and now you are another “broke college student”.

Now you have to try and live off of ramen noodle soup and hope that you can last by the end of the semester without having to ask your parents for money. Sad face.

Though, what if I can tell you that there is a way to get through college, and Dave Ramsey’s wisdom can help. A way where you can learn how to manage, save, and budget your money as a college student.

Also, as a Dave Ramsey die hard fan, I created the 3 best, simple things that you can do today (in my opinion) that can help you get to baby step millionaire just that much faster. I’d encourage you to check it out!

Dave Ramsey On Budgeting For College Students

Many people know that Dave Ramsey believes in college, but not so much in student loans. Those who are attending college at this very moment need to get on a budget right away according to Dave Ramsey. Let’s dig into how Dave Ramsey can help college students. The reason why is because so many students are financially struggling to get by and are sinking into student loans. In 2020, about 54% of college students have student debt and are continuing to pay for their education.

This is your chance to flip the switch and get on track with your finances using the tips that Dave Ramsey provided for all of us to use. Such as using Dave Ramsey’s 7 baby steps to help you throughout college. You can even personalize the baby steps to accommodate being in college. So, let’s go through all the tips and tricks to get through college financially stable.

Dave Ramsey on Investing

Dave Ramsey has spoken numerous times about investing. You can start this as early as when you are in college. Our managing editor, Dave, put together a very detailed article covering Dave Ramsey and mutual fund investing.

Here are 2 of his favorite products from the article that I like specifically for college students as they are both free.

1. Personal Capital

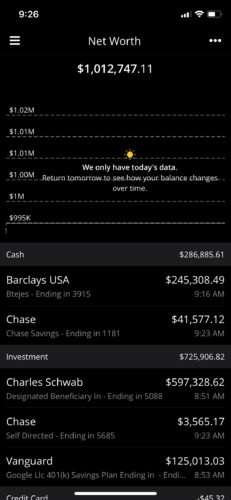

Personal Capital is one of my more favorite accounts. And best of all, it’s free. What I like is that you can see all your investments and net worth in one place. You can also see transaction data, cash flow, and budgeting. I believe this is good if you are Dave Ramsey’s Baby Step 7.

In addition, you can schedule a call with a financial advisor as Personal Capital manages over $21.8B in assets. You can have an investment checkup and also go through financial planning all through a simple to user interface.

You can sign up for a free Personal Capital account here.

Here’s a screenshot of my Personal Capital Account.

2. M1 Finance

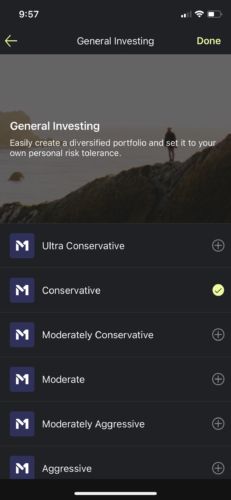

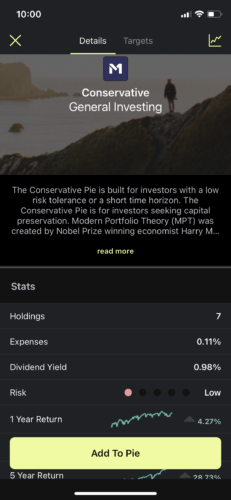

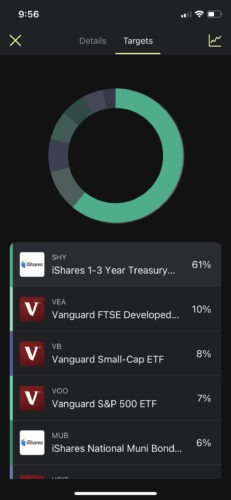

M1 Finance has been a $0 fee, $0 commission that I have been tracking since 2018. That said, I decided that it was time to move off Robinhood, so I was in the market to really dive into a new investment app. So, M1 Finance has fit the bill perfectly.

What I really like about M1 Finance is the idea of investment pies. You can easily select an investment pie that fits your investment preferences. One of the things I like least about Vanguard is that it has been really difficult for me to find: 1) What stocks are in a mutual fund. 2) The expense ratios of those mutual funds.

Thankfully, M1 Finance really solved these 2 pain points for me.

You can sign up for M1 Finance here.

Check out this M1 pie investment flow

To get here, you would open your app on the “Invest Tab” then click the “Choose Securities” button at the bottom followed by the “Expert Pies” button. I clicked on “General Investing”.

You can borrow money on M1 Finance, but I would not do that as I don’t think Dave Ramsey would approve, and I don’t like borrowing money in general, especially after the baby steps.

6 Tips For College Financial Success

1. Create a Budget

College can get quite hectic and become stressful when you are low on finances. Fear not, that’s where budgeting comes to the rescue! By making a budget, you can categorize all your expenses and figure out how much money you want to put towards. From there you can track your progress over time and see where your spending habits are. This will allow you to be more organized with your money and fix your spending problem areas. You can budget using either paper/pen, excel, or a budget app.

2. Taking Over

Now that you are in college, you won’t have your parents to rely on as much anymore. It is time for you to take charge and learn how to become financially independent. This means, having to probably sacrifice a few things in your life while being in college. For instance, no subscriptions, less take-out food, and no shopping haul. Instead, you can find roommates to save money with and try cooking more at home instead. This will help you keep your spending habits down and save money for more essentials.

3. Make a Saving Fund

In Dave Ramsey’s 7 baby steps, the first step is making an emergency fund of $1,000. For college students, this is vital to have because in college so many things can go wrong. Like your car breaking down, or maybe you broke your leg. By creating a saving fund on the side you are preparing yourself for financial stability. That way you don’t need to worry about using your funds for something else. If you think about it, you are also on track to completing the first baby step down.

4. Find a Job

A great way to earn some extra money is by applying for job opportunities in your community. That way, you can use your money towards your savings and budget to keep you financially stable throughout your college years. Don’t just find any random job though, you want to find one that gives you tips because that is where you can make your money from. For example, being a waitress, pizza delivery driver, golf caddy, and barista. All of these types of jobs can make a helpful impact on your financial situation being in college. So make your resume and start job hunting. You can also apply to on school campus jobs to make it easier for you to manage your time. This also allows you to get the Work-Study grant from the college you go to which will help you a lot financially.

5. Start Paying More

Being in college, most students have student loans they are using for their education and living. Though, many students want to start paying their debts after they have graduated college. Which can lead so many people into years of paying back their debt and struggling financially. The best way to not end up there is to start paying them back now. If you are only paying the minimum amount, you aren’t going anywhere with it. You can use budgeting by setting up a category for paying your loans every month. By paying more down on your payments you will be saving yourself time and money in the long run. If you paid it off by the time you graduated, you won’t need to worry about any interest rate on your loans over time and it will be a smoother transition in life. Since you are paying your debts, you are completing Dave Ramsey’s baby step 2 in paying all your debts. This will give you an advantage in the baby steps because now you are ahead of the game.

6. Apply for Financial Aid/Scholarships

A great way that can help you financially throughout your college year is to apply for FAFSA. It is known to help many college students who come from low-income families in need of financial support. They also offer grants when you apply for FAFSA. Even if you come from a well-incomed family, it never hurts to try and apply because of the financial opportunity you may get out of it. Dave Ramsey also preaches to apply for as many scholarships as possible. The more you apply the more chances you can be offered grants and scholarships to help you in college. There are so many different types of scholarships for college students you can apply for. Such as essays, projects, art contests, and public speaking. This gives a wide range of scholarships you can apply for that may suit the hobbies that you have. You can use that money towards your savings funds, budgeting, and even paying off your student debts.

Now it’s Your Turn…

With all these tips, you can now use it to your advantage in college to become financially stable and independent. Dave Ramsey wants you to leave college without having to pay a dime in student loans and live life to the fullest. College can be a pain at times but it’s worst being in debt. By using his tips and adding them to the 7 baby steps, you are on your way to debt freedom and financial wealth already at such a young age.

Also, if you find this article useful, I would love a share as it helps us provide unbiased content and also our Google ranking. Thanks!