The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Debt management consists of building a repayment plan that lasts for several years. Debt settlement aims to reduce your existing debt by a certain amount. Other viable alternatives include writing a hardship letter and filing for bankruptcy.

Sizeable debt can severely limit your funds and reduce opportunities to grow your wealth. Managing debt may be a national issue, as the Federal Reserve Bank of New York, found that average household debt in America rose to $17.7 trillion in the first quarter of 2024. Debt management and debt settlement are two powerful tools that can help you reduce your household financial burden in certain circumstances.

Here, we’ll break down both debt relief methods and their pros and cons, plus discuss alternate options.

Read on to learn their advantages and disadvantages, and decide which debt relief method will work for you.

Debt management breakdown

Debt management is a debt relief strategy where you budget your funds to repay outstanding balances over time. You can create a DIY debt management plan though it’s strongly advised to work with a financial advisor to access their expertise and resources.

Debt management is ideal for unsecured debt (e.g., credit cards, personal loans and student loans) where there’s no collateral involved in the agreement. Debt management plans will encourage you to make monthly payments on your balance for a set amount of time. The more you pay off your balance, the less you’ll have to pay in interest.

Advantages and disadvantages of debt management

Debt management is a long-term debt relief method that’s meant to pan out across many years. Here are some of the pros and cons of using a debt management program.

Pros

- Lower interest rates: Debt management can result in lower interest rates if you work with a financial advisor or counselor. These professionals can convince your lender to offer a lower rate than what you’re paying on your original loan.

- Boosts your credit: Sticking with a debt management plan can boost your credit over time, as payment history is the largest factor that affects your credit score. Even if you just make the minimum payment, your score will steadily improve.

- One payment: A counselor can arrange for you to be responsible for one monthly payment. This can make it easier for you to track how much you owe and how much you need to save each month.

Cons

- No new credit: While debt management is underway, you may be required to not add additional credit to your profile. It’s also possible that some of your existing accounts will be put on hold or closed as this process occurs.

- Creditors must agree: Lenders must be willing to set up a debt management plan with you for this process to begin.

Comes with fees: If you work with an advisor or a counselor, you may have to pay additional fees for their assistance. There’s normally a one-time $75 set up fee.

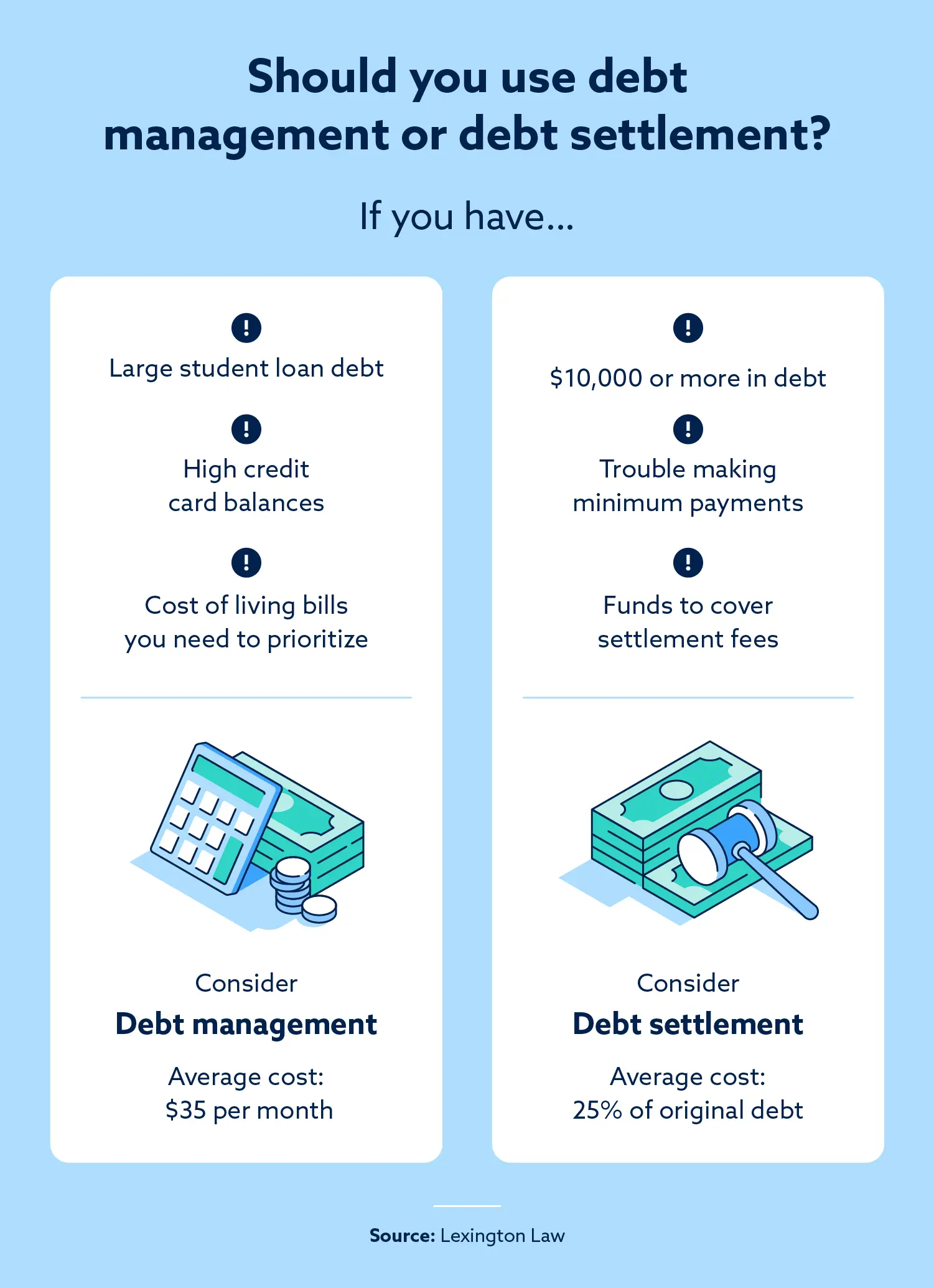

Is debt management right for you?

The best debt management programs are the ones you can realistically stick with. This method may be right for you if you’re able to budget the funds needed to satisfy your required minimum monthly payments.

It might be time to consider debt management when:

- You have the funds to afford extra fees

- You’re able to stick to a multi-year repayment schedule

- You want to reduce your total unsecured debt

What is debt settlement?

Debt settlement consists of paying a lender a certain amount of money in exchange for a reduced balance or even total debt forgiveness. Negotiation is integral to this process; you can try to negotiate yourself, or you can enlist the aid of a debt relief company.

While debt settlement can reduce your financial burden, it can also impact your credit score. That’s why it’s important to carefully consider how this option can affect you in the short and long term. The entire debt settlement process can take up to four years to complete, and the process can cost between 15 to 30 percent of your original debt.

Debt settlement pros and cons

In theory, debt settlement can reduce your financial burden and act as an alternative to options like bankruptcy. In practice, debt settlement comes with pros and cons you’ll have to consider.

Pros

- Can help avoid bankruptcy: Filing for bankruptcy is a very effective debt relief option in the right scenarios. Debt settlement is often viewed as a step to consider before committing to bankruptcy.

- Lowers your total balance: If debt settlement is successful, you can potentially lower your financial burden by as much as 50 percent of the amount owed. In certain cases, you can even settle an outstanding debt entirely.

- Speeds up repayment: Reducing the total amount of money you owe means you’ll spend less time repaying lenders.

Cons

- Affects your credit score: Debt settlement gets reported to the major credit bureaus. This can stay on your credit report for up to seven years and potentially lower your score if an account has been settled.

- Fees: Debt settlement fees normally cost between 15 and 25 percent of the original amount you owed.

- Taxes can apply: While filing your taxes, your settled debt is subject to the same taxes as ordinary income. You may have to account for this tax implication the following year.

Is debt settlement right for you?

Debt settlement programs can be a good fit for you if you’re willing and able to handle the various fees associated with this method. Secured debt isn’t typically eligible for this debt relief option, which means that credit cards and student loans aren’t normally approved for debt settlement procedures.

Debt settlement might be a strong choice for you if::

- You want to expedite your repayment plan

- You can afford the fees and taxes associated with this method

- You believe you can make your new minimum payments after settlement

Alternative means for debt relief

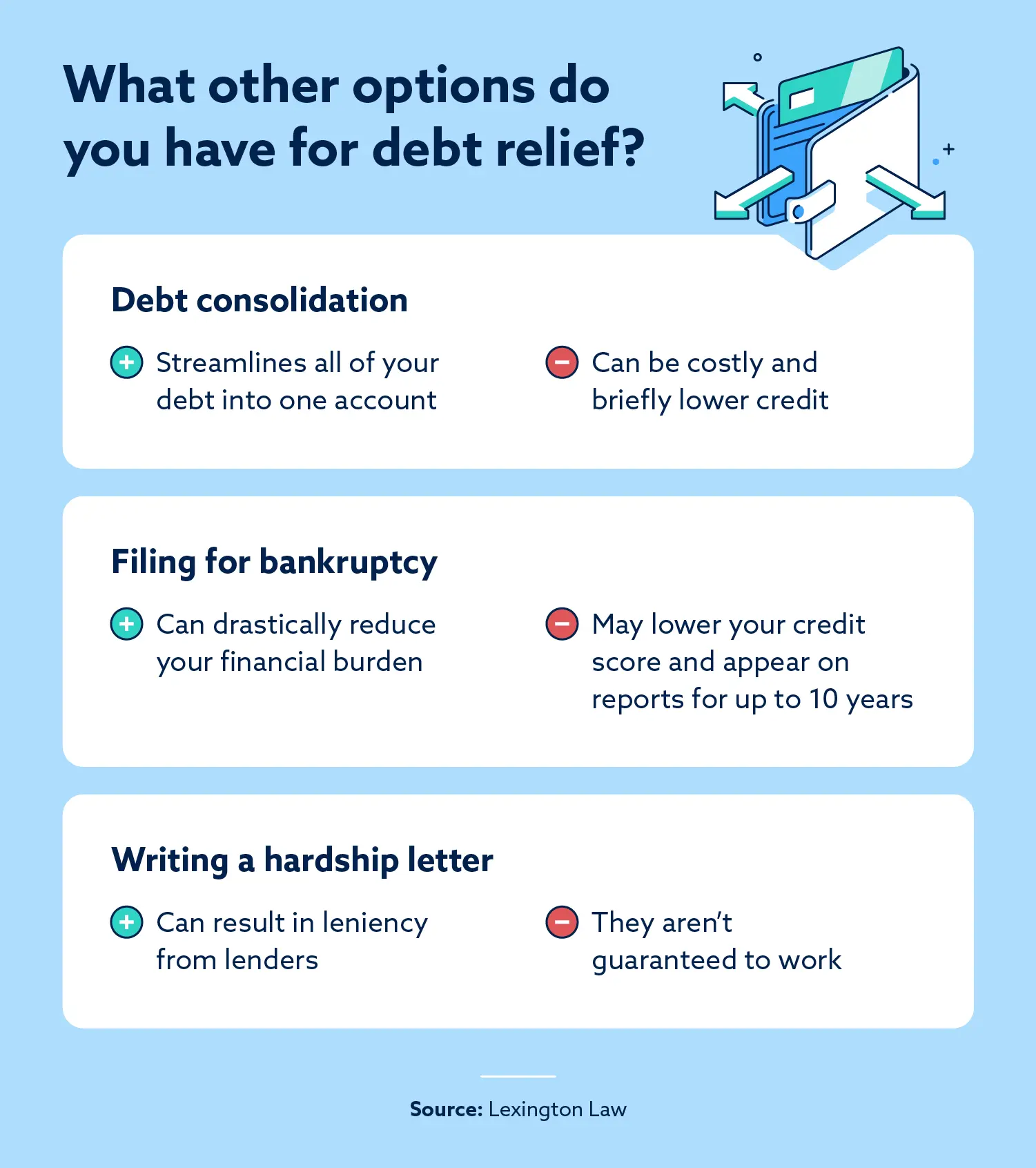

Debt management and settlement aren’t the only tools you can use to lighten your financial burden. You might consider these alternative debt relief methods for several reasons: They can better suit your budget, they might align with your scheduling needs and they can be the right fit for your credit profile.

Some alternate debt relief options include:

- Debt consolidation: You secure a debt consolidation loan that helps you move all of your existing debt onto one account. Ideally, you’ll have lower interest rates and a simpler repayment scheme.

- Bankruptcy: Filing for bankruptcy can reduce your debt to a great degree. Chapter 7 bankruptcy encourages filers to sell their assets to help reduce what they owe. Chapter 13 can result in total debt elimination so long as you plan for its impact.

- Hardship letters: A hardship or goodwill letter can result in leniency from creditors after you explain your financial situation in detail.

Explore debt relief options with Lexington Law Firm

Debt management and debt settlement are effective tools in their own right. Before pursuing any debt relief options, confirm that any negative items on your report are accurate. Lexington Law Firm’s free credit assessment can help you spot inconsistencies on your credit report. Learn more about our services to see which credit resources might help you the most.